st louis county mn sales tax

The Minnesota state sales tax rate is currently 688. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015.

St Louis County Land Sale Home Facebook

This - 50 x 125 tract is zoned R-1 Residential.

. 2022 - Total Tax Special Assessments 11400 Current Tax Due as of 3222022 Due May 15th Due October 15th Total Due 2022 - 1st Half Tax 5700 2022 - 2nd Half Tax 5700 2022 - 1st Half Tax Due 5700 2022 - 1st Half Paid 000 2022 - 2nd Half Paid 000 2022 -. 38 rows St Louis County Has No County-Level Sales Tax. Louis County is the largest county east of the Mississippi River.

Mail payment and Property Tax Statement coupon to. State Muni Services. Additional methods of paying property taxes can be found at.

To further accelerate investment and improve the quality of the countys vast. Tax forfeited land managed and offered for sale by St. This information is on your property tax statement.

Your parcel number and the amount of your tax. 6 rows The St. Revenues will fund the projects identified in the St.

Starting April 1 2015 St. Much of the area has been built on the history of logging and the abundance of iron ore. Louis County is the largest county east of the Mississippi River.

Louis County is known for its spectacular natural beauty lakes and trout streams. Contact City of Duluth Planning and Development for permitted uses and zoning questions. November 15th - 2nd Half Agricultural Property Taxes are due.

To review the rules in Minnesota visit our state-by-state guide. If your taxes are delinquent you will need to contact the County Auditor at 218-726-2383 to obtain the correct amount to pay. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval.

Permit fees do apply. Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota.

These parcels are subject to a MN Department of Transportation right of way easement. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. Tax Forfeited Land Sales.

Has impacted many state nexus laws and sales tax collection requirements. Below are some tools to help you find property information that you may be looking for. Louis County Minnesota Land and Minerals Department St.

Ad Find Out Sales Tax Rates For Free. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. Other departments may be able to help if you are looking for.

Louis County is known for its spectacular natural beauty lakes and trout streams. The 2018 United States Supreme Court decision in South Dakota v. Property Tax Look Up.

The current total local sales tax rate in Saint. Located in the arrowhead region of Northeastern Minnesota St. L miner Department St.

The right to withdraw or add any properties to this list is hereby reserved by the County Auditor. Fast Easy Tax Solutions. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in.

3 rows Saint Louis County MN Sales Tax Rate. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Checks made payable to.

Louis County Minnesota Disclaimers T erms 1. Tax Forfeit Land Sales. All properties will be sold to the highest responsible bidder at auction.

The right to withdraw any parcel from sale is hereby reserved by St. Located in the arrowhead region of Northeastern Minnesota St. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Official Payments Corporation will charge you a. The Minnesota Department of Revenue will administer these taxes. Much of the area has been built on the history of logging and the abundance of iron ore.

The St Louis County sales tax rate is 0. Pursuant to Minnesota Statute 28204 Subdivision 1 d as directed by the county board the county auditor may lease Tax Forfeited land to individuals for the removal of gravel. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2.

While many counties do levy a countywide.

Minnesota Sales And Use Tax Audit Guide

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Land Sale Home Facebook

Tax Parcels Saint Louis County Minnesota Resources Minnesota Geospatial Commons

Saint Louis County Mn Property Data Real Estate Comps Statistics Reports

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

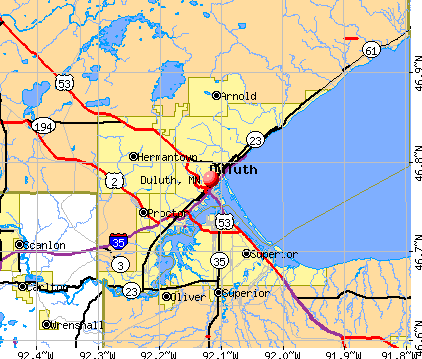

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Minnesota Sales Tax Rates By City County 2022

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota